About us

Emirates Global Holdings LLC

What is a SPAC?

Special purpose acquisition companies (SPACs) have become a preferred

way for many experienced management teams and sponsors to take

companies public. A SPAC raises capital through an initial public offering

(IPO) for the purpose of acquiring an existing operating company.

Subsequently, an operating company can merge with (or be acquired by)

the publicly traded SPAC and become a listed company in lieu of executing

its own IPO.

This approach offers several distinct advantages over a traditional IPO,

such as providing companies access to capital, even when market volatility

and other conditions limit liquidity. SPACs could also potentially lower

transaction fees as well as expedite the timeline to become a public

company.

However, the merger of a SPAC with a target company presents several

challenges, including having to meet an accelerated public company

readiness timeline as well as complex accounting and financial

reporting/registration requirements that may differ based upon the lifecycle

of the SPAC involved. The target company's management team will need

to focus on being ready to operate as a public company within three to five

months of signing a letter of intent.

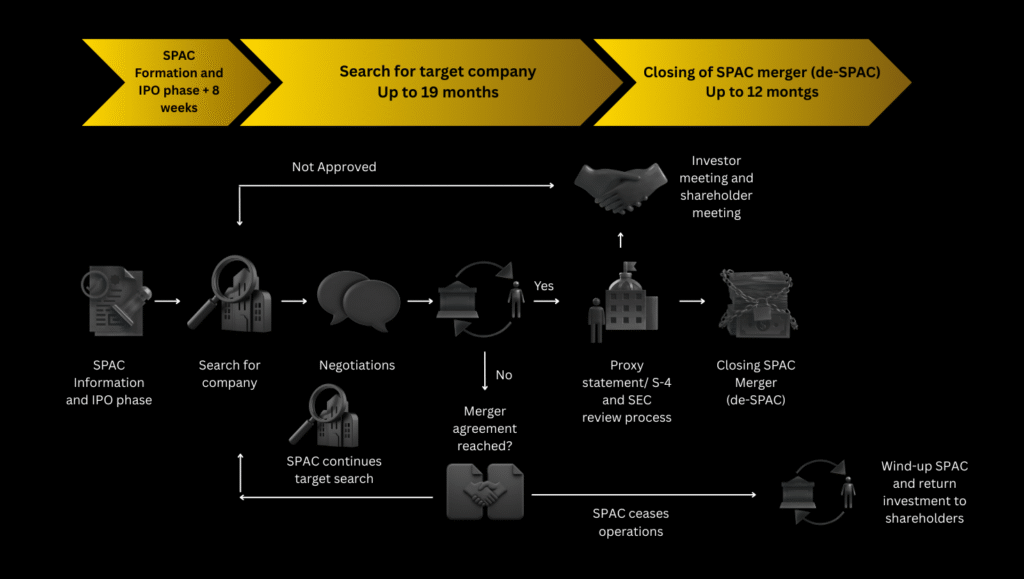

Typical SPAC timeline

SPAC life cycle*

Investor meeting &

shareholder meeting

SPAC information & IPO phase

Search for company

Negotiations

Yes

Proxy statement/ S-4 & SEC review process

Closing SPAC Merger (de-SPAC)

Merger agreement reached?

Wind-up SPAC & return investment to shareholders

A SPAC’s IPO is typically based on an investment thesis focused on a sector and geography, such as the intent to acquire a technology company in North America, or a sponsor’s experience and background. Following

the IPO, proceeds are placed into a trust account and the SPAC typically has 18-24 months to identify and complete a merger with a targetcompany, sometimes referred to as de-SPACing. If the SPAC does not complete a merger within that time frame, the SPAC liquidates and the IPО proceeds are returned to the public shareholders.

Once a target company is identified and a merger is announced, the SPAC’s public shareholders may alternatively vote against the transaction

and elect to redeem their shares. If the SPAC requires additional funds to complete a merger, the SPAC may issue debt or issue additional shares,

such as a private investment in public equity (PIPE) deal.

US M&A market at a giance

OUR TEAM

Fred Khalifa Khalilian

Chairman of the Board (COTB)

Ali Shah

Chief Executive Officer (CEO)

Nima Sadeghian

President - Chief Legal Officer (CLO)